AI-Powered Crypto Agents: The Future of Trading in 2025

- Abhinand PS

.jpg/v1/fill/w_320,h_320/file.jpg)

- Jul 22

- 3 min read

🔍 Introduction: The Dawn of Autonomous Crypto Trading

In 2025, the fusion of Artificial Intelligence (AI) and cryptocurrency trading is giving rise to a powerful new entity: AI-powered crypto agents. These digital agents—driven by advanced machine learning (ML), natural language processing (NLP), and blockchain automation—are not just tools; they’re decision-makers. From executing real-time trades to managing DeFi smart contracts autonomously, these agents are redefining the very nature of crypto investing.

Let’s dive into what they are, how they work, and why they’re about to change everything.

🤖 What Are AI-Powered Crypto Agents?

AI-powered crypto agents are autonomous systems designed to analyze data, learn from market trends, and execute trading decisions without human intervention. They blend:

Machine Learning models for pattern recognition and forecasting

Natural Language Processing for parsing news, tweets, or Reddit threads

Smart contract logic to manage digital assets

APIs and oracles for real-time market updates

These agents mimic human cognitive functions—but faster and more accurately.

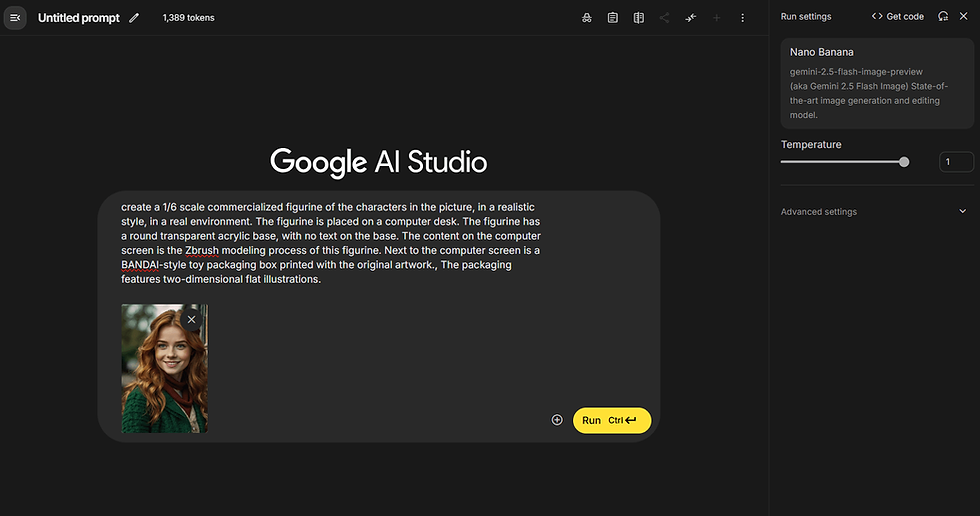

🛠️ How AI Crypto Agents Work: A Breakdown

Component | Function |

Market Data Ingestion | Pulls real-time data from exchanges and news APIs |

Sentiment Analysis (NLP) | Gauges market sentiment via social media/news |

Predictive Analytics (ML) | Forecasts price action using historical data |

Decision Engine | Applies strategy models (e.g., arbitrage, scalping, DCA) |

Execution Layer | Executes trades via APIs or smart contracts |

Risk Management | Dynamically adjusts positions based on volatility or loss thresholds |

These systems evolve with each data input, making them more adaptive and intelligent over time.

🌍 Real-World Use Cases in 2025

1. AI Trading Bots on Binance, KuCoin, and Bybit

Sophisticated bots now run multi-strategy portfolios, including:

Arbitrage between centralized and decentralized exchanges

Copy trading powered by predictive AI

High-frequency scalping based on micro-market signals

Platforms like 3Commas, Cryptohopper, and Autonio are early players integrating AI-driven logic.

2. Autonomous DeFi Portfolio Management

Agents manage assets across platforms like Uniswap, Aave, and Curve, rebalancing portfolios based on:

Gas prices

Lending APY changes

Token price correlations

3. AI Agents for NFT Market Forecasting

New bots analyze NFT market sentiment across Discord, X (Twitter), and OpenSea to make flipping decisions.

4. AI-Orchestrated Smart Contracts

Self-executing agents can trigger DeFi loans or yield farming strategies without manual input—based on on-chain data + off-chain insights.

📈 Early Movers & Startups in the Space

Project/Startup | Focus Area |

Autonomous agents for decentralized trading | |

Numerai | AI-powered hedge fund using crowd-sourced models |

SingularityDAO | Dynamic asset management using AI |

Gensyn | Decentralized infrastructure for AI training |

Autonio Foundation | AI trading tools and analytics for DeFi |

🔮 Future Potential of AI in Crypto Trading

The rise of agentic AI means we're moving toward entirely self-directed portfolios where humans merely supervise. In the future, expect:

Voice-command bots: "Hey, optimize my ETH position by 20%."

Emotion-aware agents: Bots that detect fear/greed in your speech and adjust risk exposure.

Agent marketplaces: Buy/sell specialized AI agents like you buy software today.

📌 Key Benefits of AI-Crypto Agents

🚀 Speed: React to market changes in milliseconds

🤝 Objectivity: No emotional decisions

🧠 Learning Ability: Improves performance over time

🔐 Security: Works with verifiable smart contracts

💹 Profitability: Identifies hidden arbitrage and trading opportunities

🔗 Internal & External Resources

✅ How Trading Bots Work – abhinandps.com

✅ AI Crypto Projects to Watch – Cointelegraph

✅ Binance Bot API Docs

✅ Fetch.ai Autonomous Agents

🙋♂️ FAQ: AI-Powered Crypto Agents in 2025

What makes AI agents better than traditional trading bots?

AI agents learn and adapt to the market, whereas traditional bots follow fixed rules. They can adjust strategies in real time.

Is it safe to let AI manage my crypto?

If you use audited smart contracts and trusted platforms, it’s secure. However, always start with a demo or sandbox environment.

Do I need coding skills to use these agents?

Not anymore. Platforms like 3Commas, Mudrex, and SingularityDAO offer drag-and-drop UIs and pre-trained AI models.

Are there risks involved?

Yes. AI is only as good as its data and design. Poor models or bad inputs can lead to losses. Always test first.

How can I get started?

Start by signing up on platforms offering AI crypto tools, connect your exchange API, and use preset strategies before customizing.

📢 Final Thoughts: The Trader’s Future Is Autonomous

AI-powered crypto agents aren't science fiction—they're today’s fastest-growing trading force. Whether you’re a beginner or pro, understanding and adopting these tools could be the key to outperforming the market in 2025.

The earlier you adapt, the stronger your edge will be.

Comments