Invest in Real-World Asset Tokens in 2025

- Abhinand PS

.jpg/v1/fill/w_320,h_320/file.jpg)

- Jul 22

- 3 min read

Introduction: Turning Real-World Assets into Blockchain Opportunities

What if you could own a fraction of a skyscraper or U.S. Treasury bond using just your crypto wallet?Welcome to the world of Real‑World Asset (RWA) tokenization—a fast-emerging trend where tangible assets like real estate, art, and government bonds are represented as digital tokens on the blockchain.

This isn’t just a buzzword. In 2025, RWA tokenization is becoming a mainstream investment tool, offering transparency, accessibility, and global liquidity.

Let’s explore what it means, how it works, and how you can get started—whether you're in Delhi, Dubai, or Dallas.

🔍 What Is Real-World Asset Tokenization?

RWA tokenization is the process of converting the ownership or value of a physical asset into a blockchain-based token. This token can then be bought, sold, or traded like any digital asset.

These tokens are typically:

Asset-backed (real estate, bonds, gold)

Regulated (especially if securities laws apply)

Fractional (you can own 1% of a property, not the whole thing)

Common Tokenized RWAs:

🏘️ Real estate (rental income, fractional ownership)

🖼️ Art and collectibles

💵 Bonds (e.g., U.S. Treasuries)

🌾 Commodities (e.g., tokenized gold, oil)

🧠 Why Tokenize Real-World Assets?

Benefit | Explanation |

Fractional Ownership | Access high-value assets with low capital |

Global Accessibility | Anyone with internet and a wallet can invest |

Enhanced Liquidity | Trade tokens on secondary markets 24/7 |

Instant Settlement | Blockchain automates and verifies ownership |

Transparency & Security | Smart contracts reduce fraud, increase traceability |

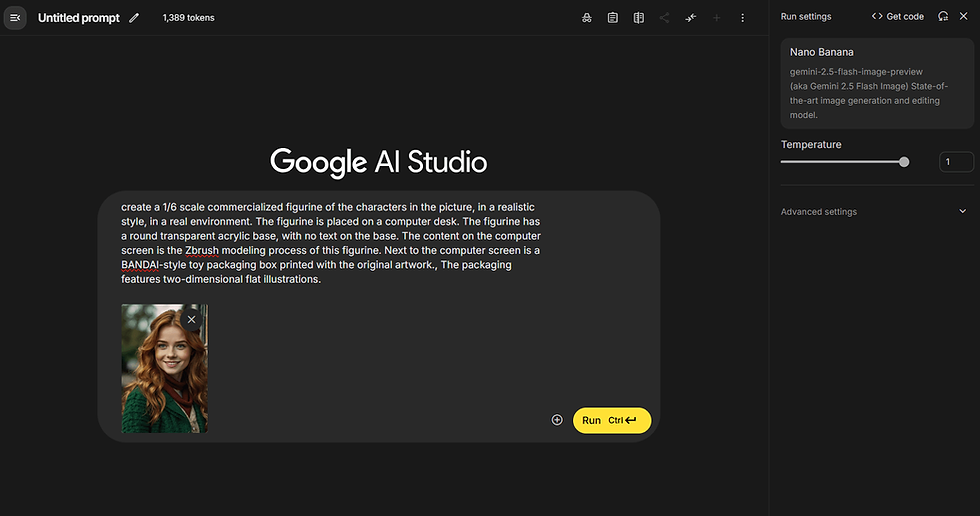

💰 How to Invest in Tokenized Real-World Assets

Here's a step-by-step beginner’s guide:

Step | Details |

1. Choose a Platform | Start with regulated platforms (e.g., RealT, Ondo, Maple) |

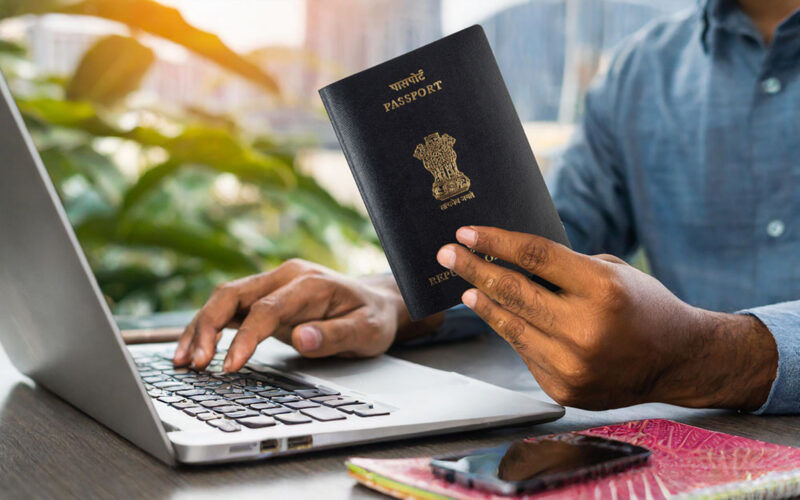

2. Complete KYC | Upload ID and verify identity to meet regulations |

3. Fund Your Wallet | Use crypto (USDC, ETH) or fiat, depending on the platform |

4. Pick Your Asset | Browse properties, bonds, art, or tokenized funds |

5. Buy Tokens | Purchase fractional shares—often as ERC-20 tokens |

6. Earn & Track Returns | Earn passive income or price appreciation, depending on asset |

🏢 Case Studies: RWA Tokenization in Action

🔹 RealT – Tokenized U.S. Real Estate

RealT offers fractional ownership in U.S. rental properties. Investors receive rental income daily in USDC on Ethereum or Gnosis Chain.

Example: $50 buys you a share in a Detroit duplex

Income: 10%+ annualized yield in some cases

🔹 Ondo Finance – Tokenized U.S. Treasuries

Ondo offers tokenized access to yield-bearing T-bills via stablecoins. Investors can earn yield while maintaining on-chain liquidity.

Minimum Investment: ~$100

Yield: Similar to 5% U.S. Treasury notes

🔹 Artrade – Tokenized Fine Art

Artrade lets you invest in curated artworks by buying fractional shares. When the art sells, you earn profit.

Assets: Art NFTs backed by real-world paintings

Access: Via Artrade wallet and app

⚠️ Risks of RWA Tokenization

Risk Type | Details |

Regulatory Uncertainty | Varies by jurisdiction; KYC and AML compliance required |

Liquidity Constraints | Not all tokens have active secondary markets |

Smart Contract Vulnerability | Bugs or exploits can lead to loss of funds |

Asset Valuation Risks | Underlying real-world asset may depreciate |

Jurisdictional Conflicts | Legal rights may differ between countries |

Pro Tip: Only invest what you can afford to lose, and always read a platform’s whitepaper, audits, and compliance documentation.

🔎 SEO Long-Tail Keywords to Target

how to invest in tokenized real estate 2025

rwa crypto projects explained

buy us treasuries on blockchain

best platforms for asset tokenization

what is rwa tokenization in crypto

realt vs ondo finance comparison

🔗 Internal & External Resources

✅ Top Crypto Investment Tools – abhinandps.com

✅ RealT – Tokenized Real Estate

✅ Ondo Finance – Tokenized Bonds

✅ Maple Finance – On-chain Credit Markets

✅ SEC Statement on Tokenization (USA)

🙋♂️ FAQ: Tokenized Real-World Assets in 2025

Is RWA tokenization legal?

Yes, in most jurisdictions—as long as platforms follow KYC/AML and securities laws. Always check regulatory status.

Can I invest with crypto or fiat?

Most platforms support both. Some require stablecoins like USDC, while others accept bank transfers.

Are these investments secure?

Blockchain-based ownership is secure, but real-world risks like property damage or regulatory changes still apply.

What kind of returns can I expect?

Returns vary by asset:

Real estate: 8–12% yield

Bonds: 4–6%

Art: Depends on resale value

What happens if the platform shuts down?

If properly decentralized and asset-backed, ownership remains verifiable on-chain, but liquidity and support may be affected.

🔚 Final Thoughts: RWA Is Crypto’s Bridge to the Real World

Tokenization of real-world assets marks a new frontier for blockchain utility—one that’s tangible, stable, and income-generating. With the right research and platform, anyone can participate in the financial revolution of digitized ownership.

Whether you’re buying a slice of Miami real estate or a piece of a Picasso, the future of investment is fractional, global, and on-chain.

Comments