Navi Personal Loan - Instant, Paperless Loans up to ₹20 Lakh

- Abhinand PS

.jpg/v1/fill/w_320,h_320/file.jpg)

- 4 hours ago

- 3 min read

Introduction

In today's fast-paced world, having quick access to funds during urgent times can be a lifesaver. Navi Personal Loan stands out as one of the most convenient, paperless, and affordable loan options in India for 2025. Whether you need money for emergencies, travel, weddings, or debt consolidation, Navi offers a seamless digital experience with flexible repayment options and competitive interest rates.

In this blog, we will explore everything you need to know about Navi Personal Loans — from features and eligibility to benefits and FAQs — all optimized with the latest SEO best practices to help you make an informed decision.

What is the Navi Personal Loan?

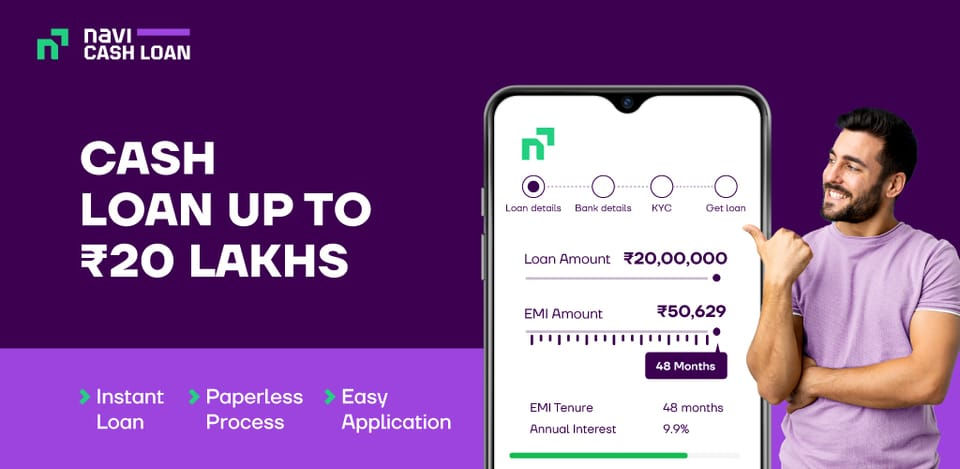

Navi Personal Loan is a wholly digital lending product offered by Navi Finserv, a trusted non-banking financial company (NBFC) in India. It provides instant, unsecured personal loans up to ₹20 lakh with interest rates starting as low as 9.9% per annum.

Key Highlights:

Loan Amount: Up to ₹20 lakh

Interest Rates: Starting from 9.9% p.a., depending on credit score

Repayment Tenure: Flexible from 12 months up to 84 months (7 years)

Processing: 100% paperless and fully online through the Navi app

Collateral: No collateral or guarantor required

Disbursal: Instant disbursal to your bank account after approval

Why Choose Navi Personal Loan?

1. Instant Approval and Disbursal

Get loan approval within minutes and the funds credited quickly without any branch visits.

2. Paperless Process

From application to disbursement, everything happens digitally, saving time and hassle.

3. Flexible EMI Options

Choose a repayment tenure that suits your financial comfort, reducing monthly EMI burdens.

4. Minimal Documentation

Only basic KYC documents like PAN and Aadhaar are required for verification.

5. Competitive Interest Rates

Interest rate as low as 9.9% p.a., based on your creditworthiness and eligibility.

6. No Hidden Charges or Collateral

Transparent fees with zero foreclosure charges and no need to pledge assets.

How to Apply for a Navi Personal Loan?

Follow these simple steps to apply:

Download the Navi App from Google Play or the App Store

Register using your mobile number and verify via OTP

Select the “Personal Loan” option

Fill out your details (PAN, salary, bank info)

Complete digital KYC via Aadhaar and video verification

Get instant approval based on your eligibility

Choose the loan amount and repayment tenure

E-sign and receive funds in your bank account

Navi Personal Loan Eligibility Criteria

To avail of a Navi Personal Loan, applicants must:

Be an Indian resident aged between 18 and 65 years

Have a valid PAN card

Be a salaried or self-employed individual

Maintain a minimum credit score of 650

Key Facts and Steps for Navi Personal Loan

Fact / Step | Details |

Maximum Loan Amount | ₹20 Lakh |

Interest Rate Range | 9.9% – 45% p.a. based on eligibility |

Repayment Duration | 12 to 84 months (1 to 7 years) |

Processing Fees | Approx. 3.99% - 6% of loan amount |

Foreclosure Charges | None |

Documentation | PAN, Aadhaar, minimal KYC |

Application Mode | Fully digital via Navi App |

Loan Disbursal | Instant (within minutes) |

Benefits of Navi Personal Loan

Instant access to funds for emergencies, education, travel, weddings, and more

No collateral or guarantor requirements

Flexible repayment options tailored to your capacity

Transparent terms with no hidden fees

Real-time EMI calculator in-app to plan your finances easily

Enjoy a seamless, hassle-free digital experience

SEO Keywords & LSI Keywords Used

Navi personal loan

Instant personal loan India 2025

Paperless personal loan

Flexible EMI options personal loan

Best personal loan app India

Unsecured personal loans

Quick personal loans without collateral

FAQs

Q1: How quickly can I get a Navi personal loan?A: Navi offers instant approval and disbursal, often within 2 to 10 minutes, once your application is approved.

Q2: What documents do I need to apply?A: Only basic documents like PAN and Aadhaar are needed, with a completely digital KYC process.

Q3: Can I prepay my loan without penalty?A: Yes, Navi allows prepayment without any foreclosure charges, helping you save on interest.

Internal and External Links

For more insights on personal finance and loan management, check out this helpful guide on abhinandps.com.Learn more about credit scores and loan eligibility on Forbes.

Take control of your finances today with Navi Personal Loan—fast, reliable, and tailored to your needs. Apply now through this link to get started: https://extp.in/cRu699

Comments